Keilor Downs

Housing loan quartiles

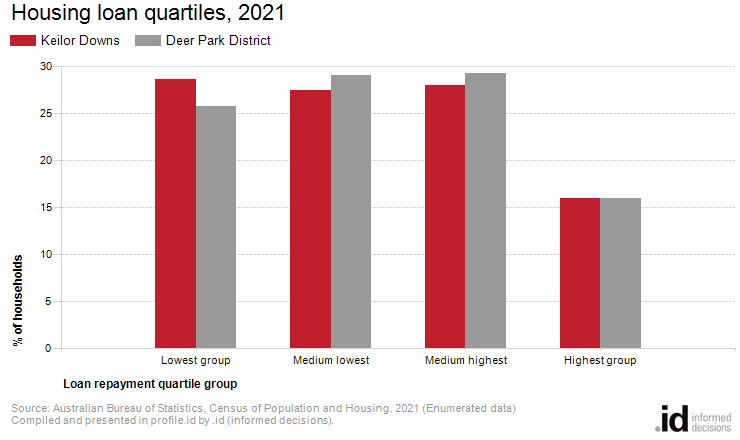

In Keilor Downs, the 'lowest group' was the largest quartile, comprising of 29% of households with mortgages in 2021.

Mortgage repayments in Keilor Downs are directly related to house prices, length of occupancy and the level of equity of home owners. When viewed with Household Income data it may also indicate the level of housing stress in the community.

The quartile method is the most objective method of comparing change in the mortgage payment profile of a community over time.

A detailed explanation of how Housing Loan Repayment quartiles are calculated and interpreted is available in specific data notes.

Please note, interest rates at the 2021 Census were at a record low in Australia. The first interest rate rises by the Reserve Bank began an upward cycle from May 2022. Please use mortgage payment data with caution as data from the 2021 Census pre-dates all official rate rises in the current cycle.

Derived from the Census questions:

'How much does your household pay for this dwelling?' and 'Is this dwelling (owned outright, owned with a mortgage etc.)'

Households with a mortgage

| Housing loan quartiles | ||||||||

|---|---|---|---|---|---|---|---|---|

| Keilor Downs - Households (Enumerated) | 2021 | 2016 | Change | |||||

| Loan repayment quartile group | Number | % | Deer Park District % | Number | % | Deer Park District % | 2016 to 2021 | |

| Lowest group | 276 | 28.6 | 25.8 | 281 | 29.1 | 20.9 | -5 | 34001 |

| Medium lowest | 265 | 27.5 | 29.0 | 249 | 25.7 | 27.2 | +16 | 34002 |

| Medium highest | 270 | 28.0 | 29.3 | 269 | 27.8 | 31.9 | +1 | 34003 |

| Highest group | 154 | 15.9 | 16.0 | 168 | 17.4 | 19.9 | -15 | 34004 |

| Total households with stated mortgage repayments | 967 | 100.0 | 100.0 | 970 | 100.0 | 100.0 | -3 | |

Source: Australian Bureau of Statistics, Census of Population and Housing (opens a new window) 2016 and 2021. Compiled and presented by .id (opens a new window)(informed decisions).

(Enumerated data)

| Housing loan - Quartile group dollar ranges | ||||||

|---|---|---|---|---|---|---|

| Calculated from loan repayment data for [theQBMQuartile] | Monthly housing loan repayments by Census year | |||||

| Housing loan repayment ranges | 2021 | 2016 | 2011 | 2006 | 2001 | |

| Lowest group | $0 to $1,252 | $0 to $1,133 | $0 to $1,103 | $0 to $831 | $0 to $596 | |

| Medium lowest | $1,253 to $1,874 | $1,134 to $1,702 | $1,104 to $1,695 | $832 to $1,261 | $597 to $866 | |

| Medium highest | $1,875 to $2,613 | $1,703 to $2,336 | $1,696 to $2,351 | $1,262 to $1,823 | $867 to $1,208 | |

| Highest group | $2,614 and over | $2,337 and over | $2,352 and over | $1,824 and over | $1,209 and over | |

Compiled and presented in profile.id by .id (informed decisions).

Compiled and presented in profile.id by .id (informed decisions).

Dominant groups

Housing loan repayment quartiles allow us to compare relative repayment liabilities across time. Analysis of the distribution of households by housing loan repayment quartiles in Keilor Downs compared to Deer Park District shows that there was a similar proportion of households in the highest repayment quartile, and a larger proportion in the lowest repayment quartile.

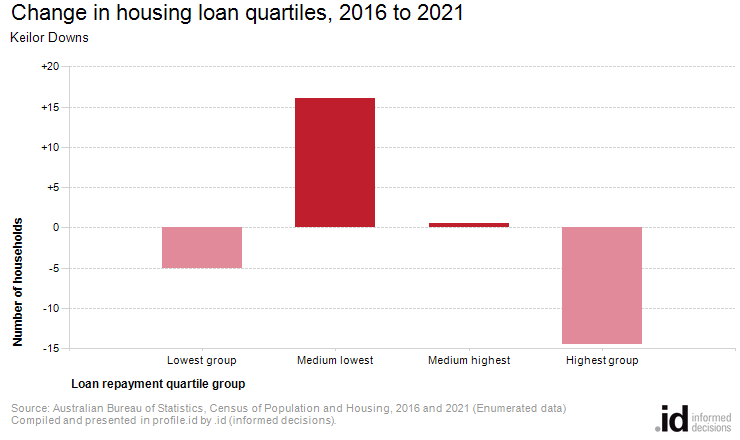

Emerging groups

The total number of households with a mortgage in Keilor Downs decreased by 970 between 2016 and 2021. The most significant change in Keilor Downs during this period was in the medium lowest quartile which showed an increase of 16 households.