South East Queensland

Housing loan quartiles

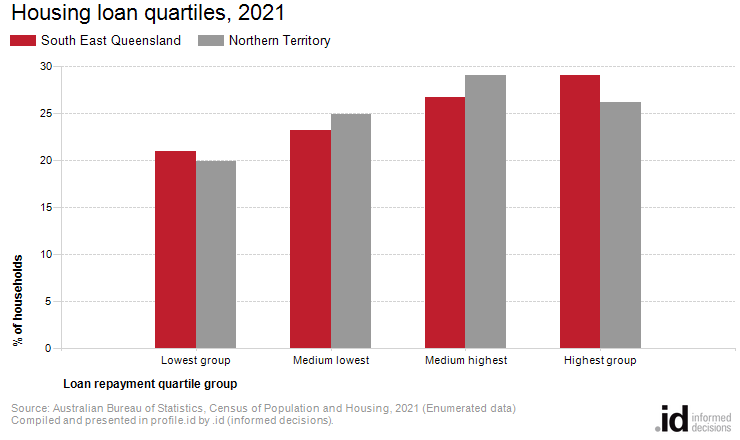

In South East Queensland, the 'highest group' was the largest quartile, comprising of 29% of households with mortgages in 2021.

Mortgage repayments in South East Queensland are directly related to house prices, length of occupancy and the level of equity of home owners. When viewed with Household Income data it may also indicate the level of housing stress in the community.

The quartile method is the most objective method of comparing change in the mortgage payment profile of a community over time.

A detailed explanation of how Housing Loan Repayment quartiles are calculated and interpreted is available in specific data notes.

Please note, interest rates at the 2021 Census were at a record low in Australia. The first interest rate rises by the Reserve Bank began an upward cycle from May 2022. Please use mortgage payment data with caution as data from the 2021 Census pre-dates all official rate rises in the current cycle.

Derived from the Census questions:

'How much does your household pay for this dwelling?' and 'Is this dwelling (owned outright, owned with a mortgage etc.)'

Households with a mortgage

| Housing loan quartiles | ||||||||

|---|---|---|---|---|---|---|---|---|

| South East Queensland - Households (Enumerated) | 2021 | 2016 | Change | |||||

| Loan repayment quartile group | Number | % | Northern Territory % | Number | % | Northern Territory % | 2016 to 2021 | |

| Lowest group | 92,482 | 21.0 | 19.9 | 85,177 | 22.4 | 16.6 | +7,305 | 34001 |

| Medium lowest | 102,359 | 23.2 | 24.9 | 89,801 | 23.6 | 19.7 | +12,558 | 34002 |

| Medium highest | 117,724 | 26.7 | 29.1 | 99,436 | 26.1 | 25.6 | +18,288 | 34003 |

| Highest group | 128,419 | 29.1 | 26.2 | 106,559 | 28.0 | 38.1 | +21,860 | 34004 |

| Total households with stated mortgage repayments | 440,986 | 100.0 | 100.0 | 380,974 | 100.0 | 100.0 | +60,012 | |

Source: Australian Bureau of Statistics, Census of Population and Housing (opens a new window) 2016 and 2021. Compiled and presented by .id (opens a new window)(informed decisions).

(Enumerated data)

| Housing loan - Quartile group dollar ranges | ||||||

|---|---|---|---|---|---|---|

| Calculated from loan repayment data for [theQBMQuartile] | Monthly housing loan repayments by Census year | |||||

| Housing loan repayment ranges | 2021 | 2016 | 2011 | 2006 | 2001 | |

| Lowest group | $0 to $1,254 | $0 to $1,184 | $0 to $1,159 | $0 to $850 | $0 to $613 | |

| Medium lowest | $1,255 to $1,873 | $1,185 to $1,784 | $1,160 to $1,804 | $851 to $1,305 | $614 to $891 | |

| Medium highest | $1,874 to $2,675 | $1,785 to $2,518 | $1,805 to $2,596 | $1,306 to $1,931 | $892 to $1,261 | |

| Highest group | $2,676 and over | $2,519 and over | $2,597 and over | $1,932 and over | $1,262 and over | |

Compiled and presented in profile.id by .id (informed decisions).

Compiled and presented in profile.id by .id (informed decisions).

Dominant groups

Housing loan repayment quartiles allow us to compare relative repayment liabilities across time. Analysis of the distribution of households by housing loan repayment quartiles in South East Queensland compared to Northern Territory shows that there was a larger proportion of households in the highest repayment quartile, as well as a larger proportion in the lowest repayment quartile.

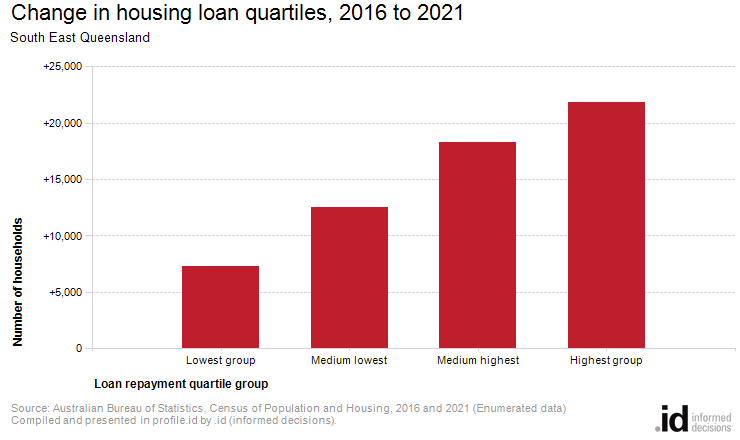

Emerging groups

The total number of households with a mortgage in South East Queensland decreased by 380,974 between 2016 and 2021. The most significant change in South East Queensland during this period was in the highest quartile which showed an increase of 21,860 households.